One of the most common responses I get when discussing the topics that I share on this blog is that “well you are killing your credit score.” To sum it up, that’s quite a naive view on how one’s credit score is determined.

I often tell people not to sign up for any credit cards for 6-12 months prior to buying a house or car (or at least not more than 1 or 2). Well, I unfortunately was placed in a position where I had to make a decision to purchase the place I currently live in. The first thing that came to mind was: “Oh no, I’ve applied for 12 cards in the past 9 months, how is that going to affect my rate?

Credit Sesame, Credit Karma and a number of “free services” can show you estimates of your scores. I’ve always been above 700, so never worried too much about it (700 is really the threshold where you should not apply for cards if you are below it). These services, though, only give you your FAKO score (an estimate of your actual FICO score). Funny enough, your Experian score that you can get from Experian for a cheap-trial period won’t even be your ACTUAL Experian score! How confusing is that?!

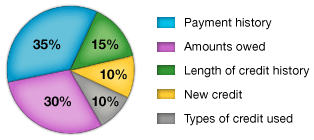

So, about that credit score. What affects it?

- Payment History is the biggest – PAY YOUR BILLS ON TIME!

- Amounts Owed – Gaining new credit can actually help this!

- Length of Credit History

- New Credit

- Types of credit used

So while new credit and length of credit history might decline some, they combine for only 20% of your score. If you get extended more credit, your utilization rate (money owed divided by total credit) decreases and actually helps improve your score! By most estimates, each credit inquiry on your account creates a 2-5 point deduction for 1 year, and then only a 1-2 point deduction for the 2nd year. After the second year it completely falls off your score.

For example, if your score is 750 and you get 1 credit card inquiry, your score might drop to 745 for 12 months, and then pop back up for 748-749 for the next 12 months, then 750 again after 12 more months. That holds true unless your utilization rate decreases, in which case your score might be affected even less.

As it turns out, I went for the loan, was approved with a great rate and was able to see my official FICO score (which I requested of the lender). It was well above 700. So while, yes, my score has decreased over the past 9 months, my credit is still extremely healthy, I’ve flown first-class to another hemisphere, stayed in 5-star hotels, and am working towards another “trip of a lifetime” all for pennies on the dollar without collateral damage.

Cheers!

Leave A Reply